[ad_1]

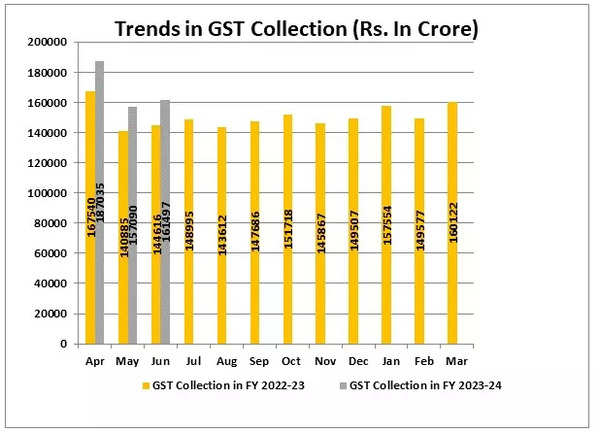

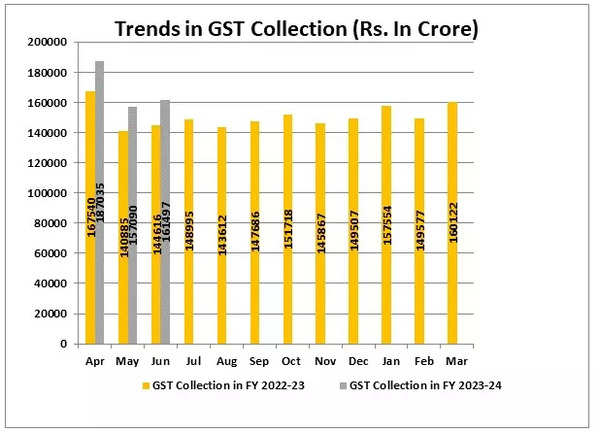

NEW DELHI: The gross Goods and Services Tax (GST) revenue collected in June 2023 was ₹1,61,497 crore, 12% higher than in the same month last year, according to data released by the finance ministry on Saturday.

Out of the gross GST collected, Central Goods and Services Tax (CGST) comprised ₹31,013 crore, State Goods and Services Tax (SGST) ₹38,292 crore, Integrated Goods and Services Tax (IGST) ₹80,292 crore (including ₹39,035 crore collected on import of goods) and cess ₹11,900 crore (including ₹1,028 crore collected on import of goods).

Out of the gross GST collected, Central Goods and Services Tax (CGST) comprised ₹31,013 crore, State Goods and Services Tax (SGST) ₹38,292 crore, Integrated Goods and Services Tax (IGST) ₹80,292 crore (including ₹39,035 crore collected on import of goods) and cess ₹11,900 crore (including ₹1,028 crore collected on import of goods).

The government has settled ₹36,224 crore to CGST and ₹30,269 crore to SGST from IGST. The total revenue of Centre and the states in June 2023 after regular settlement is ₹67,237 crore for CGST and ₹68,561 crore for SGST, said a finance ministry statement.

During the month, revenues from domestic transactions (including import of services) are 18% higher than the revenues from these sources during the same month last year.

It is for the fourth time that the gross GST collection has crossed the Rs 1.60 lakh crore mark. The average monthly gross GST collection for the first quarter of FY 2021-22, FY 22-23 & FY 23-24 are Rs 1.10 lakh crore, Rs 1.51 lakh crore and Rs 1.69 lakh crore respectively.

[ad_2]